UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________________ SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

_________________________________________________________________ Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ý | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

AXONICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1 | | Title of each class of securities to which transaction applies: |

| | 2 | | Aggregate number of securities to which transaction applies: |

| | 3 | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4 | | Proposed maximum aggregate value of transaction: |

| | 5 | | Total fee paid: |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1 | | Amount Previously Paid: |

| | 2 | | Form, Schedule or Registration Statement No.: |

| | 3 | | Filing Party: |

| | 4 | | Date Filed: |

April 30, 2021May 1, 2023

Dear Fellow Stockholders,

Thank you for your support of Axonics®.

We have made significant and measurable progress sincecontinued support. Since last year’s annual meeting of stockholders.stockholders, we have made significant progress growing Axonics and advancing our mission of improving the quality of life for adults with incontinence.

Notably, In 2022, Axonics sacral neuromodulation (SNM) and Bulkamid® therapies were used to treat over 65,000 adults worldwide. And yet we are still just scratching the surface of what we believe is possible in the large, underserved, undertreated markets in which we participate.

Axonics generated total net revenue of $111.5$274 million in fiscal year 2020 despite the COVID-19 pandemic. This result compares2022, an increase of 52% compared to $13.8 million of net revenue in fiscal year 2019.2021. Gross margin in 20202022 was 60.2%,72% compared to gross margin of 53.0%64% in fiscal year 2019. The increase2021. Axonics generated positive cash flow from operations in revenue2022 and margin is primarily dueremains well capitalized, with over $350 million of cash on hand as of year-end 2022.

We also continued to Axonics’ commercial launchmake progress on several key initiatives, including our direct-to-consumer advertising campaign, expansion of our in-house manufacturing capabilities, the introduction of our long-lived recharge-free SNM system (Axonics F15™), and in January 2023, FDA approval of our fourth-generation rechargeable SNM system (Axonics R20™).

During 2022, we also increased our field team headcount, which now totals approximately 340 sales professionals and clinical specialists in the United States in late 2019.

In addition, during 2020 and early 2021 Axonics received additional FDA approvals for enhancements to its sacral neuromodulation product offering, including a rechargeable implantable neurostimulator (INS) with a one-month recharging interval, a new patient remote control with SmartMRI® technology, 3 Tesla MRI full-body conditional labeling, an upgraded programmer and a third-generation INS which gives patients the ability to make broader stimulation parameter adjustments at home.

On February 25, 2021, we announced the acquisition of Contura, Ltd. and its Bulkamid® product, a urethral bulking agent indicated for the treatment of female stress urinaryStates. Our incontinence (SUI). As a result of acquiring Bulkamid and having products to treat both overactive bladder and SUI, we have changed our corporate name to Axonics, Inc., to reflect our broader product portfolio beyond solely neuromodulation.

Axonics has established a significant commercial infrastructure, with over 220 sales personnel and clinical specialists, an increase of 50 field-based employees compared to 2019 and wetherapies continue to make significant investmentsgenerate high levels of satisfaction from physicians and their patients. We remain confident that our commitment to build our commercial organizationinnovation, quality and providing strong clinical support will continue to drive market expansion and support our products. With respectadvance Axonics on its path to product performance and support, feedback from both patients and clinicians has been outstanding. Despite COVID-19 and the short-term impact on our business, we remain bullish about Axonics’ prospects for strong growth in the second half of 2021 and into 2022. As of December 31, 2020, Axonics had 416 employees.incontinence market leadership.

You are cordially invited to attend the Axonics, Inc. 2021our 2023 Annual Meeting of Stockholders, which will be held virtually on Wednesday, June 23, 202126, 2023, at 12:00 p.m. Eastern Time. Stockholders of record and beneficial owners of our common stock who register for the meeting in advance will be able to participate in the meeting,Annual Meeting, vote, and submit questions during the meetingAnnual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/AXNX2021.AXNX2023. If you are a stockholder of record, a secure control number that will allow you to attend the meetingAnnual Meeting electronically can be found on your proxy card. In the following pages, you will find the Notice of Annual Meeting and Proxy Statement describing the business to be conducted at the Annual Meeting.

We have opted to hold the Annual Meeting virtually in an effort to make it convenient and safefor as many stockholders as possible to attend. You will not be able to attend the Annual Meeting in person. We plan, however, to provide a brief overview of our business answering questions from stockholders.

At the Annual Meeting, we are asking you to elect our director nominees and vote on the other important matters described in the accompanying notice. We urge you to vote in favor of the election of each of our director nominees. In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on April 27, 20212023 a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”).Materials. The notice contains instructions regarding how to access our Proxy Statement for the Annual Meeting and our 20202022 Annual Report to Stockholders, as well as how to vote via proxy either by telephone or online. If you would like to receive a printed copy of our proxy materials instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice.

We encourage you to access the proxy materials online and cast your vote using the instructions provided so that your shares are represented at the Annual Meeting.

If you have any questions, please contact Kingsdale Advisors, our proxy solicitor, by telephone at (866) 851-3215 (stockholders) and (416) 867-2272 (banks and brokerage firms), or by email at contactus@kingsdaleadvisors.com.

We thank you for being a shareholderstockholder of Axonics.

Sincerely,

Raymond W. Cohen

Chief Executive Officer

NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

To be held Wednesday, June 23, 202126, 2023

To Our Stockholders,

Notice is hereby given that the 20212023 Annual Meeting of Stockholders (the “Annual Meeting”) of Axonics, Inc., a Delaware corporation (“Axonics”), will be held virtually on Wednesday, June 23, 202126, 2023, at 12:00 p.m. Eastern Time. You will not be able to attend the Annual Meeting in person. Stockholders of record, and beneficial owners of our common stock who register for the meetingAnnual Meeting in advance, will be able to participate in the meeting,Annual Meeting, vote, and submit questions during the meetingAnnual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/AXNX2021.AXNX2023. To participate in the meeting,Annual Meeting, you must have your 16-digit control number that is shown on your Notice of Internet Availability or on your proxy card if you receive the proxy materials by mail. The Annual Meeting is being held on a virtual-only basis.

The Annual Meeting will be held for the following purposes:

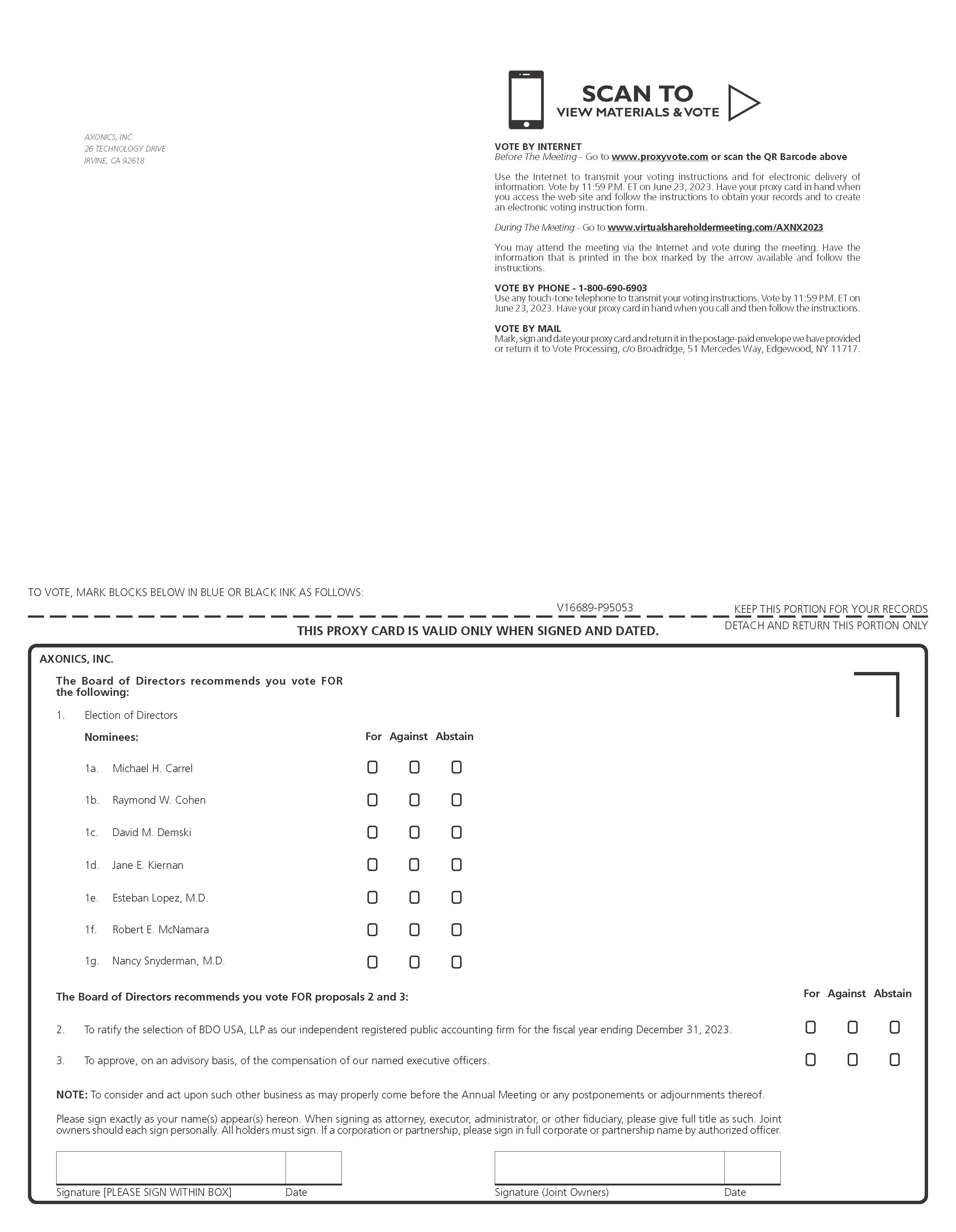

1. To elect the sixseven directors named in the Proxy Statement to serve until our Annual Meeting to be held in 2022,2024, or until their successors are duly elected and qualified or until his or her earlier resignation or removal.

2. To ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2023.

3. To approve, on an advisory basis, the compensation of our named executive officers.

4. To hold an advisory vote on the frequency of future advisory votes to approve compensation of our named executive officers.

5. To consider and act upon such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

The Board of Directors (the “Board”) recommends that you vote “FOR” each of the director nominees named in Proposal 1 and “FOR” Proposals 2 and 3 and “FOR” the option of “Every Year” as the preferred frequency for future advisory votes.3.

The Board has fixed the close of business on April 27, 20212023 as the record date for determining the holders of our common stock entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof. Only stockholders of record at the close of business on the record date are entitled to such notice and to vote, virtually or by proxy, at the Annual Meeting.

A list of stockholders will be available for examination by any stockholder at the Annual Meeting and at our corporate headquarters, located at 26 Technology Drive, Irvine, CA 92618, for a period of ten days prior to the Annual Meeting.

Your vote is very important. Our goal for the Annual Meeting is to enable the broadest number of stockholders to participate in the meetingAnnual Meeting at the lowest cost to them, while providing substantially the same access and exchange with the Board and management as an in-person meeting.Annual Meeting. As such, we believe that we observe best practices for virtual stockholder meetings, including by providing a support line for technical and other assistance, addressing as many stockholder questions as time allows, and by posting all questions and answers posed at the Annual Meeting on our website within a reasonable time. Accordingly, additional information on how you can participate in the virtual Annual Meeting to the fullest extent is set forth in the “Questions and Answers About the Virtual Annual Meeting and Voting” section of this Proxy Statement, which begins on page 1. Regardless of whether you expect to attend the meeting,Annual Meeting, please complete, date, sign and return the proxy card, or submit your voting instructions over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting.Annual Meeting.

Sincerely,

Raymond W. Cohen

Chief Executive Officer

Approximate Date of Mailing of Notice of

Internet Availability of Proxy Materials: May 11, 20211, 2023

| | |

Important Notice Regarding Availability of Proxy Materials for the Virtual Annual Meeting on June 23, 2021:26, 2023: Axonics’ Notice of Annual Meeting of Stockholders, Proxy Statement and 20202022 Annual Report to Stockholders are available at www.virtualshareholdermeeting.com/AXNX2021.AXNX2023.

|

TABLE OF CONTENTS

PROXY STATEMENT

The enclosed Proxy Statement and related materials are being furnished on behalf of the Board of Directors (the “Board”) of Axonics, Inc. (“Axonics,” the “Company,” “we,” “us,” or “our”), in connection with the solicitation by the Board of proxies to be voted at the virtual 20212023 Annual Meeting of Stockholders to be held on June 23, 202126, 2023 at 12:00 p.m. Eastern Time (the “Annual Meeting”), or at any postponements or adjournments thereof. We are providing these materials to holders of record of our common stock as of the close of business on the record date of April 27, 20212023 (the “Record Date”) and are first making available or mailing the materials on or about May 11, 2021.1, 2023. The Annual Meeting is being held for the purposes described in this Proxy Statement and in the accompanying Notice of Annual Meeting of Stockholders.

QUESTIONS AND ANSWERS ABOUT THE VIRTUAL ANNUAL MEETING AND VOTING

The following questions and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the rules and regulations of the Securities and Exchange Commission (the “SEC”). These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about the Proxy Statement or the Annual Meeting, please see “Whom should I contact with other questions?” below.

1. What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will be asked to consider and vote upon the matters described in this Proxy Statement and in the accompanying Notice of Annual Meeting, and any other matters that properly come before the Annual Meeting.

2. When and where will the Annual Meeting be held?

You are invited to attend the virtual Annual Meeting on Wednesday, June 23, 202126, 2023, at 12:00 p.m. Eastern Time. Stockholders of record, and beneficial owners of our common stock who register for the meetingAnnual Meeting in advance, will be able to participate in the meeting,Annual Meeting, vote, and submit questions during the meetingAnnual Meeting conducted via live webcast by visiting www.virtualshareholdermeeting.com/AXNX2021.AXNX2023. If you are a stockholder of record, a 16-digit secure control number that will allow you to attend the meetingAnnual Meeting electronically can be found on your proxy card.

3. Why is the Annual Meeting being webcast?

The Annual Meeting is being held on a virtual-only basis in order to enable participation by the broadest number of stockholders possible, to save costs compared to a physical meeting and to keep everyone safe in light of the global pandemic resulting from COVID-19. We are one of many prominent Delaware publicly-traded companies to hold a virtual-only meeting and, as such, we are confident in the technology and believe that it enables stockholders to participate in the Annual Meeting more easily.

4. How can I participate and ask questions at the Annual Meeting?

We are committed to ensuring that our stockholders have substantially the same opportunities to participate in the virtual Annual Meeting as they would at an in-person meeting. In order to submit a question at the Annual Meeting, you will need your 16-digit control number that is printed on the proxy card that you received in the mail, or via email if you have elected to receive material electronically. You may log in 15 minutes before the start of the Annual Meeting and submit questions online. You will be able to submit questions during the Annual Meeting as well. We encourage you to submit any question that is relevant to the business of the meeting.Annual Meeting. All appropriate questions asked during the Annual Meeting will be read and addressed during the meeting.Annual Meeting. Stockholders are encouraged to log into the webcast at least 15 minutes prior to the start of the meetingAnnual Meeting to test their internet connectivity.

5. 4. What if I have technical or other “IT” problems logging into or participating in the Annual Meeting webcast?

We have provided a toll-free technical support “help line” that can be accessed by any stockholder who is having challenges logging into or participating in the virtual Annual Meeting. If you encounter any difficulties accessing the virtual

meetingAnnual Meeting during the check-in or meeting time, please call the technical support line number that will be posted on the Virtual Shareholder Meeting login page.

6. 5. Why am I receiving these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of proxies to be voted at the Annual Meeting, and at any adjournment or postponement thereof. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. You are invited to attend the virtual Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual

Meeting to have your shares voted. Instead, you may have your shares voted using one of the other voting methods described in this Proxy Statement. Regardless of whether you expect to attend the Annual Meeting, please submit your proxy as soon as possible in order to ensure your representation at the Annual Meeting and to minimize our proxy solicitation costs.

7. 6. What is a “proxy”?

The term “proxy,” when used with respect to a stockholder, refers to either a person or persons legally authorized to act on the stockholder’s behalf or a format that allows the stockholder to vote without attending the virtual Annual Meeting.

Because it is important that as many stockholders as possible be represented at the Annual Meeting, the Board is asking that you review this Proxy Statement carefully and then vote by following the instructions set forth on the Notice of Internet Availability or the proxy card. In voting prior to the Annual Meeting, you will deliver your proxy to Raymond W. Cohen and Dan L. Dearen, which means you will authorize Mr. Cohen and Mr. Dearen to vote your shares at the Annual Meeting in the way you instruct. All shares represented by valid proxies will be voted in accordance with the stockholder’s specific instructions.

8. 7. Why did I receive a notice in the mail regarding the Internet availability of proxy materials?

Instead of mailing printed copies to each of our stockholders, we have elected to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. These rules allow us to make our stockholders aware of the Annual Meeting and the availability of our proxy materials by sending a Notice of Internet Availability, which provides instructions regarding how to access the full set of proxy materials through the Internet or make a request to have printed proxy materials delivered by mail in addition to instructions regarding how to attend the virtual Annual Meeting through the Internet. Accordingly, on or about May 11, 2021,1, 2023, we mailed a Notice of Internet Availability to each of our stockholders who held shares of our common stock as of the Record Date. The Notice of Internet Availability contains instructions regarding how to access our proxy materials, including our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 20202022 (the “Annual Report”). The Notice of Internet Availability also provides instructions regarding how to vote your shares.

9. 8. What is the purpose of complying with the SEC’s “notice and access” rules?

We believe compliance with the SEC’s “notice and access” rules will allow us to provide our stockholders with the materials they need to make informed decisions about the matters to be voted upon at the Annual Meeting, while lowering the costs of printing and delivering those materials and reducing the environmental impact of our Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice.Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

10. 9. What does it mean if I receive more than one Notice of Internet Availability?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Notice of Internet Availability, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

11. 10. Can I vote my shares by filling out and returning the Notice of Internet Availability?

No. The Notice of Internet Availability identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice of Internet Availability and returning it. If you would like a paper proxy card, you should follow the instructions in the Notice of Internet Availability. The paper proxy card you receive will also provide instructions as to how to authorize via the Internet or telephone your proxy to vote your shares according to your voting instructions. Alternatively, you can mark the paper proxy card with how you would like your shares voted, sign the proxy card and return it in the envelope provided.

12. 11. What am I being asked to vote upon at the Annual Meeting?

At the Annual Meeting, you will be asked to:

•Elect sixseven director nominees to serve until the Annual Meeting to be held in 2022,2024, or until their successors are duly elected and qualified (Proposal 1);

•Ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20212023 (Proposal 2);

•Approve, on an advisory basis, the compensation of our named executive officers (Proposal 3); and

•Hold an advisory vote on the frequency of future advisory votes to approve compensation of our named executive officers (Proposal 4); and

•To considerConsider and act upon such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

12. What are the voting options for each Proposal?

In the election of directors (Proposal 1), you may vote “FOR” any one or more of the nominees, you may vote “AGAINST” any one or more of the nominees or you may “ABSTAIN” from voting with respect to the election of any one or more of the nominees. On the ratificationall of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 2) and the approval, on an advisory basis, of the compensation of our named executive officers (Proposal 3),other proposals, you may vote “FOR,” “AGAINST” or “ABSTAIN.” On the advisory vote on the frequency of future advisory votes to approve compensation of our named executive officers (Proposal 4), you may vote every “ONE YEAR,” “TWO YEARS” or “THREE YEARS” or “ABSTAIN”.

14. 13. How does the Board recommend that I vote?

The Board recommends that you vote your shares:

•“FOR” the election of each of the sixseven director nominees named in this Proxy Statement to serve until the Annual Meeting of Stockholders to be held in 2022,2024, or until their successors are duly elected and qualified or their earlier resignation or removal (Proposal 1);

•“FOR” the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for fiscal year ending December 31, 20212023 (Proposal 2); and

•“FOR” the approval, on an advisory basis, of the compensation of our named executive officers (Proposal 3); and

•“FOR” the option of “Every Year” as the preferred frequency for future advisory votes (Proposal 4).

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card, who are persons designated by the Board and are members of our management team, will vote in accordance with the recommendations of the Board. Management does not know of any matters that will be brought before the Annual Meeting other than those specifically set forth in this Proxy Statement. However, if any other business properly comes before the Annual Meeting, the proxy holders or their substitutes will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

15. 14. Who can vote at the Annual Meeting?

If you were a holder of our common stock as a “stockholder of record,” or if you are the “beneficial owner” of our common stock held in “street name,” as of the close of business on the Record Date, you may vote your shares at the virtual Annual Meeting, and at any postponements or adjournments of the Annual Meeting. As of the Record Date, there were 41,902,48650,383,730 shares of our common stock outstanding. Each stockholder has one vote for each share of common stock held as of the Record Date. A list of our stockholders will be available for examination by any stockholder at the Annual Meeting and at our corporate headquarters, located at 26 Technology Drive, Irvine, CA 92618, for a period of ten days prior to the Annual Meeting.

16. 15. What does it mean to be a “stockholder of record”?

If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a “stockholder of record.” As a “stockholder of record,” you may vote at the virtual Annual Meeting or vote by proxy. Regardless of whether you plan to attend the Annual Meeting, we urge you to vote your shares using one of the voting methods described in this Proxy Statement and the Notice of Internet Availability.

17. 16. What does it mean to be a “beneficial owner” of shares held in “street name”?

If, on the Record Date, your shares were held in an account at a broker, bank, or other financial institution (we refer to each of those organizations collectively as a “broker”), then you are the “beneficial owner” of shares held in “street name” and these proxy materials are being made available to you by that broker. The broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. You have the right to direct your broker on how to vote the shares in your account by following the instructions printed on the Voting Instruction Form received from the bank, broker or other institution holding your stock.

Under the rules that govern brokers, your broker is not permitted to vote on your behalf on any matter to be considered at the Annual Meeting (other than the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for 2021)2023) unless you provide specific instructions to the broker as to how to vote. As a result, we encourage you to communicate your voting decisions to your broker before the date of the Annual Meeting to ensure that your vote will be counted.

18.17. How do I obtain voting instructions if my stock is held in “street name”?

If your stock is held in “street name,” you will receive a notice, typically entitled “Voting Instruction Form” or something similar, either electronically or by mail from the bank, broker or other institution holding your stock. This notice contains instructions regarding how to access the proxy materials and how to vote.

18. If I hold my stock in street name and fail to provide specific voting instructions to the bank, broker or other institution holding it on my behalf, will my stock still get voted?

Not on all matters. If you hold your shares in street name and want a vote to be cast on your behalf for all proposals described in this Proxy Statement, you must submit your specific voting instructions to the bank, broker or other institution holding the stock on your behalf in response to the notice you receive from it.

20. 19. What are “broker non-votes”?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (i) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (ii) the broker lacks the authority to vote the shares at their discretion.

Proposal Nos. 1 3 and 43 are considered non-discretionary matters, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposals. Proposal No. 2 for the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal.

21. 20. What documentation must I provide to be admitted to the online Annual Meeting and how do I attend?

If your shares are registered in your name, you will need to provide your 16-digit control number included on your Notice of Internet Availability or your proxy card (if you receive a printed copy of the proxy materials) in order to be able to participate in the meeting.Annual Meeting. If your shares are not registered in your name (if, for instance, your shares are held in “street name” for you by your broker, bank or other institution), you must follow the instructions printed on your Voting Instruction Form. In order to participate in the Annual Meeting, please log on to www.virtualshareholdermeeting.com/AXNX2021AXNX2023 at least 15 minutes prior to the start of the Annual Meeting to provide time to register and download the required software, if needed. The webcast replay will be available at www.virtualshareholdermeeting.com/AXNX2021AXNX2023 until the 20212024 Annual Meeting of Stockholders. If you access the meetingAnnual Meeting but do not enter your control number, you will be able to listen to the proceedings, but you will not be able to vote or otherwise participate.

22. 21. What documentation must I provide to vote online at the Annual Meeting?

If you are a stockholder of record and provide your 16-digit control number when you access the meeting,Annual Meeting, you may vote all shares registered in your name during the Annual Meeting webcast. If you are not a stockholder of record as to any of your shares (i.e., instead of being registered in your name, all or a portion of your shares are registered in “street name” and held by your broker, bank or other institution for your benefit), you must follow the instructions printed on your Voting Instruction Form.

23. 22. How many shares must be present or represented to conduct business at the Annual Meeting?

The presence at the Annual Meeting of the holders of a majority of the outstanding shares of common stock, as of the Record Date, virtually or by proxy and entitled to vote, will constitute a quorum, permitting us to conduct our business at the Annual Meeting. “Abstentions” and “broker non-votes” will each be counted as present at the Annual Meeting for purposes of

determining the existence of a quorum at the Annual Meeting. “Broker non-votes” will result for shares that are not voted by the broker who is the record holder of the shares because the broker is not instructed to vote on such matter by the beneficial owner of the shares and the broker does not have discretionary authority to vote on such matter. For further discussion on broker non-votes, please refer to “What are the voting requirements to approve the proposals?”below. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

24. 23. How can I vote my shares of Axonics stock?

Stockholders of record can vote by proxy or by attending the Annual Meeting and voting. The persons named as proxies on the proxy card were designated by the Board and are members of our management. If you vote by proxy, you can do so by submitting a proxy over the Internet or by telephone as described below. If you are the beneficial owner of shares held in street name, please refer to the information forwarded by your broker to see which voting options are available to you and to see what steps you must follow if you choose to attend the virtual Annual Meeting to vote your shares.

•Submit a Proxy by Internet: You can submit a proxy over the Internet in advance of the virtual Annual Meeting by following the instructions provided on the proxy card or the voting instruction card provided to you by your broker, if applicable.

•Submit a Proxy by Telephone: If you requested to receive printed proxy materials, you can submit a proxy by telephone in advance of the virtual Annual Meeting pursuant to the instructions provided on the proxy card or by following the voting instruction card provided to you by your broker, if applicable.

•Vote in Person at the Annual Meeting: If you are a stockholder of record, you may attend the Annual Meeting and vote via the virtual meetingAnnual Meeting website, www.virtualshareholdermeeting.com/AXNX2021,AXNX2023, where stockholders may vote and submit questions during the meeting.Annual Meeting. Please have your 16‑digit control number to join the Annual Meeting. Instructions on how to attend and participate via the Internet are posted at www.virtualshareholdermeeting.com/AXNX2021.AXNX2023. Even if you plan to attend the Annual Meeting, we encourage you to submit a proxy in advance by Internet, telephone or mail so that your vote will be counted in the event you later decide not to attend the Annual Meeting. The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend the virtual Annual Meeting. If you are the beneficial owner of shares, held in “street name,” you must obtain a legal proxy, executed in your favor by your broker, to be able to vote at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. We encourage you to submit your proxy even if you plan to attend the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, the individuals named as your proxy holders will vote your shares as you have directed. Regardless of whether you plan to attend the Annual Meeting, and regardless of the number of shares of our stock that you own, it is important that your shares are represented at the Annual Meeting.

25. 24. Can I change my vote after I have submitted my vote?

Yes. You may revoke your proxy at any time before the vote is taken at the virtual Annual Meeting. If you are a stockholder of record, you may change your vote by (i) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method); (ii) providing written notice of revocation to our Secretary at our corporate headquarters located at 26 Technology Drive, Irvine, CA 92618, prior to your shares being voted; or (iii) participating in the virtual meetingAnnual Meeting and voting. Attendance at the virtual meetingAnnual Meeting will not cause your previously granted proxy to be revoked unless you vote at the meetingAnnual Meeting or specifically so request. For shares you hold beneficially in “street name,” you may change your vote by submitting new voting instructions to your broker, bank, trustee or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the online meetingAnnual Meeting and voting.

26. 25. What are the voting requirements to approve the proposals?

Assuming that a quorum is present at the Annual Meeting, the voting requirements to approve each of the proposals to be voted upon at the Annual Meeting are as follows:

•Election of Directorsdirectors (Proposal 1) — Directors will be elected by a plurality of the votes cast with respect to each director’s election at the Annual Meeting, in person or by proxy. Abstentions will have no effect on the outcome of this Proposal. The election of directors is a “non-discretionary” matter, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the election of directors, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes will have no effect in determining which directors are elected at the Annual Meeting.

•Ratification of Selectionselection of Independent Registered Public Accounting Firm (Proposal 2) — Ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20212023 will require the affirmative vote of a majority of the shares present in person or represented by

proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will be counted toward the tabulation of votes present or represented on this Proposal and will have the same effect as votes against this Proposal. The ratification of BDO USA, LLP is a “discretionary” matter, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to the ratification of BDO USA, LLP, your broker may use its discretion to vote your uninstructed shares on this Proposal. A failure by your broker to vote your uninstructed shares on this Proposal will result in an abstention, which will have the same effect as a vote against this Proposal.

•Approve, on an advisory basis, the compensation of our named executive officers (Proposal 3) — Approval, on an advisory basis, of the compensation of our named executive officers will require the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will be counted toward the tabulation of votes present or represented on this Proposal and will have the same effect as votes against this Proposal. The approval, on an advisory basis, of the compensation of our named executive officers is a “non-discretionary” matter, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to this Proposal, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes will have no effect on the outcome of this Proposal.

•Approve the frequency of the number of years stockholders approve our named executive officer compensation (Proposal 4) — Approval of the frequency of the number of years stockholders approve the compensation of our named executive officers will require the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter. Abstentions will be counted toward the tabulation of votes present or represented on this Proposal and will have the same effect as votes against this Proposal. Approval of the frequency of the number of years stockholders approve the compensation of our named executive officers is a “non-discretionary” matter, meaning that if you are the beneficial owner of your shares and do not instruct your broker how to vote with respect to this Proposal, your broker is not permitted to vote on this Proposal and your votes will be counted as broker non-votes. Broker non-votes will have no effect on the outcome of this Proposal.

27. 26. Could other matters be decided at the Annual Meeting?

As of the date this Proxy Statement was made available to stockholders, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. However, if any other matters are presented for consideration at the Annual Meeting including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place in order to solicit additional proxies in favor of one or more of the Proposals, the persons named as proxy holders and acting thereunder will have discretion to vote on these matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote.

28. 27. Who is paying for the cost of this proxy solicitation?

The proxies being solicited hereby are being solicited by us, and the cost of soliciting proxies in the enclosed form will be borne by us. We have also retained Kingsdale Advisors (“Kingsdale”), to aid in the solicitation. For these services, we will pay Kingsdale a fee of approximately $19,500approximately $12,500 and reimburse it for certain out-of-pocket disbursements and expenses. Our officers and other employees may, without compensation other than their regular compensation, solicit proxies by further mailings, personal conversations, telephone, facsimile or other electronic means. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

29. 28. What is the deadline to submit stockholder proposals for our 20222024 Annual Meeting of Stockholders?

Under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), any stockholder desiring to include a proposal in our Proxy Statement with respect to our 20222024 Annual Meeting of Stockholders should arrange for such proposal to be delivered to us at our corporate headquarters no later than January 11, 2022,1, 2024, in order to be considered for inclusion in our proxy statement relating to such annual meeting. Matters pertaining to such proposals, and the eligibility of persons entitled to have such proposals included, are regulated by the Exchange Act and the rules of the SEC.

In addition, pursuant to our bylaws,Bylaws, any stockholder desiring to submit a proposal for action or nominate one or more persons for election as directors at our 20222024 Annual Meeting of Stockholders pursuant to the advance notice provisions of our bylawsBylaws must submit a notice of the proposal or nomination to us between February 23, 202226, 2024 and March 25, 2022,27, 2024, or else it will be considered untimely and ineligible to be properly brought before the Annual Meeting. In each case, the notice of the proposal or nomination must include certain information specified in our bylaws,Bylaws, including information concerning the nominee or proposal, as the case may be, and information about the stockholder’s ownership of and agreements relating to our capital stock. However, if our 20222024 Annual Meeting of Stockholders is not held between May 24, 202226, 2024 and September 1, 2022,3, 2024, under our bylaws,Bylaws, this notice must be provided not earlier than the 120th day prior to the 20222024 Annual Meeting of Stockholders and not later than the close of business on the later of (a) the 90th day prior to the 20222024 Annual Meeting of Stockholders or (b) the

10th day following the date on which notice of the date of the 20222024 Annual Meeting of Stockholders is first mailed to stockholders or otherwise publicly disclosed, whichever first occurs.

All such notices should be directed to our Secretary at our corporate headquarters located at Axonics, Inc., 26 Technology Drive, Irvine, CA 92618. For more information, and for more detailed requirements, please refer to our Amended and Restated Bylaws, filed as Exhibit 3.2 to our Current Report on Form 8-K (File No. 001-38721), filed with the SEC on November 5, 2018.

30. 29. I share an address with another stockholder, and we received only one copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

The SEC rules permit brokers to participate in a practice known as “householding,” which means that only one copy of the Notice of Internet Availability and, if applicable, this Proxy Statement and the Annual Report, will be sent to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. Householding is designed to reduce printing and postage costs, and results in cost savings for us. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. If you receive a householding mailing this year and would like to have additional copies of our Notice of Internet Availability and, if applicable, this Proxy Statement and/or the Annual Report mailed to you, or if you would like to opt out of this practice for future mailings, please contact your broker or submit your request to our General Counsel at Axonics, Inc., 26 Technology Drive, Irvine, CA 92618, or by telephone at (949) 396-6322. Upon receipt of any such request, we agree to promptly deliver a copy of the Notice of Internet Availability and, if applicable, this Proxy Statement and/or the Annual Report to you. In addition, if you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact us using the contact information set forth above.

31. 30. Where can I find voting results of the Annual Meeting?

We will announce preliminary voting results with respect to each proposal at the Annual Meeting. In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that time in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once they are known by us.

31. Whom should I contact with other questions?

If you have additional questions about this Proxy Statement or the Annual Meeting, please contact Kingsdale, our proxy solicitor, by telephone at (866) 851-3215 (stockholders) and (416) 867-2272 (banks and brokerage firms), or by email at contactus@kingsdaleadvisors.com.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth, as of April 27, 20212023, information regarding beneficial ownership of our capital stock by:

•each of our named executive officers;

•each of our directors;

•all of our directors and executive officers as a group; and

•each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding common stock.

The number of shares of common stock beneficially owned by each person is determined under the rules of the SEC. Under these rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares that the individual has the right to acquire by June 26, 20212023 (sixty days after April 27, 2021)2023) through the exercise or conversion of a security or other right. Unless otherwise indicated, each person has sole investment and voting power, or shares such power with a family member, with respect to the shares set forth in the following table. The inclusion in this table of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares for any other purpose.

Our calculation of the percentage of beneficial ownership is based on 41,902,48650,383,730 shares of our common stock outstanding.outstanding as of April 27, 2023.

Except as otherwise noted below, the address for each person or entity listed in the table is c/o Axonics, Inc., 26 Technology Drive, Irvine, California 92618.

| Name and Address of

Beneficial Owner | Name and Address of

Beneficial Owner | | Amount and Nature of Shares

Beneficially Owned | | % | Name and Address of

Beneficial Owner | | Amount and Nature of Shares

Beneficially Owned | | % |

| Named Executive Officers and Directors | Named Executive Officers and Directors | | | | | Named Executive Officers and Directors | | | | |

Raymond W. Cohen(1) | Raymond W. Cohen(1) | | 694,930 | | | 1.65 | | Raymond W. Cohen(1) | | 557,953 | | | 1.10 | |

Dan L. Dearen(2) | Dan L. Dearen(2) | | 144,629 | | | * | Dan L. Dearen(2) | | 26,337 | | | * |

Karen Noblett, M.D.(3) | | 61,106 | | | * | |

Rinda K. Sama(4) | | 77,503 | | | * | |

Alfred Ford Jr.(5) | | 13,239 | | | * | |

Rinda K. Sama(3) | | Rinda K. Sama(3) | | 93,645 | | | * |

John Woock, Ph.D.(4) | | John Woock, Ph.D.(4) | | 82,484 | | | * |

Alfred Ford, Jr.(5) | | Alfred Ford, Jr.(5) | | 52,950 | | | * |

Nancy Snyderman, M.D., FACS(6) | Nancy Snyderman, M.D., FACS(6) | | 26,750 | | | * | Nancy Snyderman, M.D., FACS(6) | | 31,111 | | | * |

Robert E. McNamara(7) | Robert E. McNamara(7) | | 25,833 | | | * | Robert E. McNamara(7) | | 30,194 | | | * |

Michael H. Carrel(8) | Michael H. Carrel(8) | | 26,000 | | | * | Michael H. Carrel(8) | | 30,361 | | | * |

Jane E. Kiernan(9) | Jane E. Kiernan(9) | | 24,750 | | | * | Jane E. Kiernan(9) | | 16,861 | | | * |

David M. Demski(10) | David M. Demski(10) | | 3,500 | | | * | David M. Demski(10) | | 16,542 | | | * |

All executive officers and directors as a group (10 persons)(11) | | 1,098,240 | | | 2.59 | | |

Esteban López, M.D.(11) | | Esteban López, M.D.(11) | | 5,600 | | | * |

All executive officers and directors as a group (12 persons)(12) | | All executive officers and directors as a group (12 persons)(12) | | 944,038 | | | 1.85 | |

| Greater than 5% Holders | Greater than 5% Holders | | Greater than 5% Holders | | |

FMR LLC(12) | | 4,857,906 | | | 11.59 | | |

Credit Suisse AG(13) | | 2,530,981 | | | 6.04 | | |

| FMR LLC(13) | | FMR LLC(13) | | 2,718,792 | | | 5.40 | |

BlackRock, Inc.(14) | | BlackRock, Inc.(14) | | 3,630,843 | | | 7.21 | |

The Vanguard Group(15) | | The Vanguard Group(15) | | 5,092,888 | | | 10.11 | |

* Less than 1%.

(1)Includes (i) 238,834397,357 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021,2023, and (ii) 292,339100,981 shares of common stock held by the Cielo Trust established March 30, 2018. Mr. Cohen is a trustee of the Cielo Trust established March 30, 2018, and as a result, shares voting and dispositive power over the shares held by it.

(2) Includes 134,6292,344 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021.2023.

(3)Includes 23,653(i) 23,954 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021.

(4)Includes (i) 28,3232023, (ii) 608 shares of common stock held by Mr. Sama’s spouse and (iii) 13,229 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021, (ii) 4,000 shares of common stock2023 held by Mr. Sama’s spouse and (iii) 5,885spouse.

(4) Includes 17,182 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021 held by Mr. Sama’s spouse.2023.

(5) Includes 7,6142,116 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021.2023.

(6)Consists of 12,583 shares of restricted common stock held by Dr. Snyderman andIncludes 14,167 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021 held by Dr. Snyderman.2023.

(7)Consists of 7,500 shares of restricted common stock held by Mr. McNamara andIncludes 18,333 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021 held by Mr. McNamara.2023.

(8)Consists of 11,000 shares of restricted common stock held by Mr. Carrel andIncludes 15,000 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021 held by Mr. Carrel.2023.

(9)Consists of 10,583 shares of restricted common stock held by Ms. Kiernan and 14,167Kiernan.

(10) Includes 10,000 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021 held by Ms. Kiernan.2023.

(10)(11) Consists of shares of restricted common stock held by Mr. Demski.Dr. López.

(11)(12)Includes 438,938513,682 shares of common stock underlying stock options exercisable within 60 days of April 27, 2021.2023.

(12)(13) Based solely on a Schedule 13G13G/A filed with the SEC on February 8, 20219, 2023 by FMR LLC, FMR LLC has sole voting power with respect to 960,7122,665,590 shares of our common stock and sole dispositive power with respect to 4,857,9062,718,792 shares of our common stock. The address of FMR LLC is 245 Summer Street, Boston, MA 02210.

(13)(14) Based solely on a Schedule 13G/A filed with the SEC on January 31, 2023 by BlackRock, Inc., BlackRock, Inc. has sole voting power with respect to 3,571,988 shares of our common stock and sole dispositive power with respect to 3,630,843 shares of our common stock. The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055.

(15) Based solely on a Schedule 13G filed with the SEC on February 12, 2021March 10, 2023 by Credit Suisse AG, Credit Suisse AGThe Vanguard Group, The Vanguard Group has shared voting andpower with respect to 83,103 shares of our common stock, sole dispositive power with respect to 2,530,9814,964,256 shares of our common stock and shared dispositive power with respect to 128,632 shares of our common stock. The address of Credit Suisse AGThe Vanguard Group is Uetlibergstrasse 231, PO Box 900, CH 8070, Zurich, Switzerland.

100 Vanguard Blvd., Malvern, PA 19355.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file initial statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5) of our common stock with the SEC. Executive officers, directors and greater than ten-percent stockholders are required to furnish us with copies of all such forms they file.

Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons that no additional forms were required, we believe that all filing requirements applicable to our executive officers, directors and greater than ten-percent stockholders were complied with for the fiscal year ended December 31, 2020,2022, except that due to administrative errors, a Form 4 was not filed within the required period for the following: (i) two Formsone Form 4 and twothree transactions for Mr. Dearen reporting shares granted on January 31, 2022, (ii) one Form 4 and three transactions for Mr. Ford reporting shares granted on January 31, 2022, (iii) one Form 4 and three transactions for Mr. Woock reporting shares granted on January 31, 2022, (iv) one Form 4 and three transactions for Mr. Cohen reporting shares soldgranted on January 13, 2020 and February 13, 2020 , (ii)31, 2022, (v) one Form 4 and two transactions for Mr. Wisniewski reporting shares sold on January 17, 2020 and January 22, 2020, (iii) one Form 4 and two transactions for Andera Partners reporting shares sold on January 17, 2020 and January 22, 2020, (iv) three Forms 4 and three transactions for Mr. Sama reporting shares soldgranted on February 6, 2020, October 29, 2020January 31, 2022, (vi) two Form 4s and November 25, 2020, (v) two Forms 4 and twosix transactions for Mr. DearenMs. Noblett reporting shares granted on January 31, 2022 and options exercised and shares sold on February 13, 2020 and May 11, 2020, and (vi)September 12, 2022, (vii) one Form 4 and one transactionthree transactions for Mr. WoockMs. Kiernan reporting options exercised on August 5, 2021 and shares sold on August 28, 2020, were inadvertently not timely filed.April 1, 2022.

Changes in Control

We are not aware of any arrangements that have resulted, or may at a subsequent date result, in a change ofin control of Axonics.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

There have been no transactions since January 1, 2020,2022, in which the amount involved in the transaction exceeded or will exceed the lesser of $120,000 and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock, or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than compensation arrangements for our directors and executive officers, which are described under “Director Compensation” and “Executive Compensation”.

Policies and Procedures for Transactions with Related Persons

We have adopted a written related-person transactions policy that sets forth our policies and procedures regarding the identification, review, consideration, ratification and oversight of “related-person transactions.” For purposes of our policy only, a “related-person transaction” is a transaction, arrangement or relationship (or any series of similar transactions) in which we and any “related person” are participants involving an amount that exceeds $120,000. Transactions involving compensation for services provided to us as directors or executive officers are not considered related-person transactions under this policy. A related person is any executive officer, director or a holder of more than 5% of any class of our equity, including any of their immediate family members and any entity owned or controlled by such persons.

Under the policy, where a transaction has been identified as a related-person transaction, management must present information regarding the proposed related-person transaction to our audit committee for review, consideration and approval. The presentation must include a description of, among other things, the material facts, the direct and indirect interests of the related persons, the benefits of the transaction to us and whether any alternative transactions or other sources of comparable products or services are available. To identify related-person transactions in advance, we will rely on information supplied by our executive officers, directors and certain significant stockholders. In considering related-person transactions, our audit committee or other independent body of the Board will take into account the relevant available facts and circumstances including, but not limited to:

•the risks, costs and benefits to us;

•the impact on a director’s independence in the event the related person is a director, immediate family member of a director or an entity with which a director is affiliated;

•the terms of the transaction;

•the availability of other sources for comparable services or products; and

•the terms available to or from, as the case may be, unrelated third parties or to or from our employees generally.

In the event a director has an interest in the proposed transaction, the director must recuse himself or herself from the deliberations and approval. Our audit committee will approve only those related-person transactions that are in the best interests of our company, as our audit committee determines in good faith.

EXECUTIVE OFFICERS

Each of our executive officers serves at the discretion of the Board. The determination as to which of our employees qualify as executive officers was made by the Board in accordance with the rules of the SEC. Biographical information for our executive officers as of the date this Proxy Statement was made available is set forth below. There are no family relationships between any of our directors or executive officers. There are no legal proceedings related to any of the executive officers that must be disclosed pursuant to Item 401(f) of Regulation S-K.

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Raymond W. Cohen | | 62 64 | | | Chief Executive Officer, Director |

| Dan L. Dearen | | 58 60 | | | President, Chief Financial Officer |

| Rinda K. Sama | | 42 44 | | | Chief Operating Officer |

| John Woock, Ph.D. | | 40 | | | Executive Vice President, Chief Marketing & Strategy Officer |

| Alfred Ford, Jr. | | 50 52 | | | Chief Commercial Officer |

John Woock, Ph.D. | | 38 | | | Chief Marketing Officer |

| Karen Noblett, M.D. | | 58 60 | | | Chief Medical Officer |

For biographical information for Raymond W. Cohen, please refer to Proposal 1.

Dan L. Dearen has served as our President since August 2018 and our Chief Financial Officer since October 2013. From October 2013 to August 2018, Mr. Dearen served as our Chief Operating Officer. From July 2009 to October 2013, Mr. Dearen served as Chief Operating Officer and Chief Financial Officer of Vessix Vascular, Inc., a developer of a novel renal denervation system used to treat uncontrolled hypertension, which was acquired by Boston Scientific Corporation. Previously, he served as Chief Financial Officer of Miraval Holding, Q3DM, Medication Delivery Devices and was a Principal at Ventana Growth Funds, an international venture capital firm investing in medical devices, life sciences and healthcare companies. Mr. Dearen started his career as a CPA (inactive) in the healthcare group at Ernst & Young in Dallas, Texas. He holds a B.B.A. in Accounting & Business from Southern Methodist University and an M.B.A. from Boston College and completed the Accredited Public Company Director Certification program at the University of California Los Angeles. In March of 2021, Mr. Dearen joined the Board of Directors of Endotronix, Inc., a digital health and medical technology company, as an Independent Director and Chair of the Audit Committee and in January of 2023, Mr. Dearen joined the Board of Directors of JenaValve Technology, Inc. a developer and manufacturer of transcatheter aortic valve replacement systems, as an Independent Director and Chair of the Audit Committee.

Rinda K. Sama has served as our Chief Operating Officer since August 2018. From May 2014 to August 2018, Mr. Sama served as our Vice President, Operations and Quality. From June 2011 to May 2014, Mr. Sama served as Director, Operations and Quality of Vessix Vascular, Inc. Since July 2021, Mr. Sama served on the board of directors of BioVentrix, a privately held medical device company focused on treating congestive heart failure via transcatheter based ventricular restoration. Mr. Sama holds a B.S. in Biomedical Engineering from Karnatak University Dharwad, a M.S. in Biomedical Engineering from the University of Southern California and an M.B.AM.B.A. from the University of California, Irvine.

John Woock, Ph.D. has served as our Executive Vice President, Chief Marketing & Strategy Officer since December 2021. Prior to that time, Mr. Woock served as our Chief Marketing Officer from June 2018 to November 2021, as our Vice President, Global Marketing and Clinical Operations from January 2017 to May 2018 and our Vice President, Product Marketing from June 2014 to December 2016. Before working with our company, he was a postdoctoral fellow at the Stanford Biodesign Program at Stanford University from August 2013 to June 2014 and a management strategy consultant at McKinsey & Company from February 2010 to August 2013. Mr. Woock holds a B.S. in Biomedical Engineering from Washington University in St. Louis and a Ph.D. in biomedical engineering from Duke University.

Alfred Ford, Jr. has served as our Chief Commercial Officer since November 2017. From January 1997 to June 2017, Mr. Ford served as President and Chief Commercial Officer, General Manager, Vice President, Global Sales & Marketing, Vice President, Sales, Distribution Director, Regional Sales Manager and Territory Manager of Cardiac Science, Inc., a manufacturer of external automatic defibrillators. Mr. Ford holds a B.S. in Marketing and an M.S. in International Marketing from Saint Joseph’s University.

John Woock, Ph.D. has served as our Chief Marketing Officer since June 2018. Prior to that time, Mr. Woock served as our VP, Global Marketing and Clinical Operations from January 2017 to May 2018 and our VP, Product Marketing from June 2014 to December 2016. Before working with our company, he was a postdoctoral fellow at the Stanford Biodesign Program at Stanford University from August 2013 to June 2014. Mr. Woock holds a B.S. in Biomedical Engineering from Washington University in St. Louis and a Ph.D. in biomedical engineering from Duke University.

Karen Noblett, M.D. has served as our Chief Medical Officer since October 2017 and as a physician advisor to Axonics from January 2014 until joining us as an employee. From August 2014 to September 2017, Dr. Noblett served as Professor and Department Chair, OB/GYN, at the University of California, Riverside. From October 1998 to July 2014, Dr. Noblett served as Professor and Division Director at the University of California, Irvine. From July 1995 to June 1998, Dr. Noblett completed her fellowship in Female Pelvic Medicine and Reconstructive Surgery and from July 1991 to June 1995, she completed her residency in Obstetrics and Gynecology at the University of California, Irvine. In June 2019, Dr. Noblett

completed her M.B.A. at the University of California, Irvine. Dr. Noblett holds a B.A. in Biology from California State University, Fresno, an M.D. from the University of California, Irvine, and an M.S. in Research from the University of California, San Diego.

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board currently consistsconsists of sixseven annually-elected directors. Acting upon the recommendation of our Nominatingnominating and Corporate Governance Committee,corporate governance committee, the Board nominated Michael H. Carrel, Raymond W. Cohen, Jane E. Kiernan, Robert E. McNamara, Nancy Snyderman, M.D., FACS, and David M. Demski, and Esteban López, M.D. for election to the Board at the Annual Meeting.

Each director will be elected to serve a one-year term expiring at the Annual Meeting of Stockholders to be held in 20222024 and until his or her successor has been duly elected and qualified, or until his or her earlier resignation or removal.

Each of the nominees has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the proxy holders will vote for the substitute nominee designated by the Board. The Board has no reason to believe that any of the nominees will be unable to serve. There are no family relationships between any of our directors or executive officers. There are no legal proceedings related to any of the directors or director nominees which must be disclosed pursuant to Item 401(f) of Regulation S-K. No stockholder has any special rights regarding the election or designation of members of the Board. There are no agreements or understandings pursuant to which any of the directors was selected to serve as a director.

Director Qualifications

The Board has determined that, as a whole, it must have the right mix of characteristics, skills and diversity to provide effective oversight of our company. In selecting directors, the Board seeks to achieve a mix of directors that enhances the diversity of background, skills and experience on the Board, including with respect to age, gender, international background, ethnicity and specialized experience. Directors should have relevant expertise and experience and be able to offer advice and guidance to our Chief Executive Officer based on that expertise and experience.

Each director is also expected to:

•possess fundamental qualities of intelligence, honesty, perceptiveness, maturity, integrity, fairness and responsibility;

•have a genuine interest in Axonics and recognize that as a member of the Board, each director is accountable to all of our stockholders, not to any particular interest group;

•be of the highest ethical character and share the values of Axonics as reflected in our Code of Conduct;

•be highly accomplished in his or her field, with superior credentials and recognition;

•possess sound business judgment, be able to work effectively with others, have sufficient time to devote to our affairs; and be free from conflicts of interest; and

•have independent opinions and be willing to state them in a constructive manner.

The Board periodically reviews the diversity of skills and characteristics needed in the Board’s oversight of our company, as well as the effectiveness of the mix of skills and experience. The Board considers the skill areas represented on the Board, those skill areas represented by any directors who are expected to retire or leave the Board in the near future, and recommendations of directors regarding skills that could improve the ability of the Board to carry out its responsibilities.

Identifying and Evaluating Nominees

When the Board or its nominating and corporate governance committee has identified the need to add a new director with specific qualifications or to fill a vacancy on the Board, the chairChair of the nominating and corporate governance committee will initiate a search, seeking input from other directors and senior management, review any candidates that the nominating and corporate governance committee has previously identified, and, if necessary, hire a search firm. The nominating and corporate governance committee will identify the initial list of candidates who satisfy the specific criteria and otherwise qualify for membership on the Board. Selected members of the Board will interview each qualified candidate; other directors will also interview the candidate if practicable. Based on a satisfactory outcome of those interviews, the nominating and corporate governance committee will make its recommendation on the candidate to the Board.

Our bylawsBylaws include a procedure that stockholders must follow in order to nominate a person for election as a director at an annual meeting of stockholders. The bylawsBylaws require that timely notice of the nomination in proper written form, including all required information, be provided to the Corporate Secretary.

Required Vote of Stockholders

A plurality of the votes cast with respect to each director’s election at the Annual Meeting is required for the election of each director. Abstentions will have no effect in determining which directors are elected at the Annual Meeting.

Proxies received in response to this solicitation will be voted “FOR” the election of the above-named nominees to the Board unless otherwise specified in the proxy.

Board Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOLLOWING SIXSEVEN NOMINEES.

| | Name | Name | | Age | | Position(s) | | Serving Since | Name | | Age | | Position(s) | | Serving Since |

| Raymond W. Cohen | Raymond W. Cohen | | 62 | | | Chief Executive Officer, Director | | 2013 | Raymond W. Cohen | | 64 | | | Chief Executive Officer, Director | | 2013 |

| Robert E. McNamara | Robert E. McNamara | | 64 | | | Director | | 2018 | Robert E. McNamara | | 66 | | | Director | | 2018 |

| Michael H. Carrel | Michael H. Carrel | | 50 | | | Director | | 2019 | Michael H. Carrel | | 52 | | | Director | | 2019 |

| Nancy Snyderman, M.D., FACS | Nancy Snyderman, M.D., FACS | | 69 | | | Director | | 2019 | Nancy Snyderman, M.D., FACS | | 71 | | | Director | | 2019 |

| Jane E. Kiernan | Jane E. Kiernan | | 60 | | | Director | | 2019 | Jane E. Kiernan | | 62 | | | Director | | 2019 |

| David M. Demski | David M. Demski | | 63 | | | Director | | 2021 | David M. Demski | | 65 | | | Director | | 2021 |

| Esteban López, M.D. | | Esteban López, M.D. | | 50 | | | Director | | 2021 |

Raymond W. Cohen has served as our Chief Executive Officer and as a member of the Board since our inception in October 2013. Mr. Cohen has extensive medical device experience, holding several Chair and Chief Executive Officer positions on the boards of publicly listed life sciences companies. Mr. Cohen is an accredited public company director having completed the UCLA certification program for public company directors. Since August 2020,2021, Mr. Cohen served as a memberthe Chairman of the board of directors of BioVentrix, a privately held medical device company focused on treating congestive heart failure via transcatheter based ventricular restoration. From November 2013 to July 2021, Mr. Cohen has served as a member of the board of directors since November 2013 and ChairChairman of the board of directors and member of audit committee, compensation committee and nominating committees of BioLife Solutions, Inc., (NASDAQ: BLFS), a developer, manufacturer and supplier of proprietary clinical grade cell and tissue hypothermic storage and cryopreservation freeze media for human cells. From June 2013 to April 2020, Mr. Cohen served as a member of the board of directors, Chair of the compensation committee, member of the audit committee and member of the nominating and corporate governance committee of Spectrum Pharmaceuticals, Inc., (NASDAQ: SPPI), a developer and marketer of oncology and hematology drugs. From April 2016 to June 2017, Mr. Cohen served as a member of the board of directors and a member of the compensation and audit committees of publicly listed Zurich-based LifeWatch AG, a manufacturer and marketer of ambulatory electrocardiogram services, which was acquired by Biotelemetry Inc. (NASDAQ: BEAT), in July 2017. From June 2013 to December 2017, Mr. Cohen served as Chair of the board of directors of Lombard Medical, Inc., a manufacturer and marketer of abdominal aortic aneurysm stent graphs. From August 2010 to November 2012, Mr. Cohen served as Chief Executive Officer and as a member of the board of directors of Vessix Vascular, Inc., a developer of a novel renal denervation system used to treat uncontrolled hypertension, which was acquired by Boston Scientific Corporation. From 1997 to 2006, Mr. Cohen served as Chief Executive Officer of Nasdaq-listed Cardiac Science, Inc., a manufacturer of external automatic defibrillators. From 1982 to 1997, Mr. Cohen served in various sales and marketing positions for a number of medical device companies. In 2021, Cohen was named by Ernst & Young as Entrepreneur of the Year for the Southwest United States. In 2008, Mr. Cohen was named by AeA as the Private Company Life Science Chief Executive Officer of the Year. Mr. Cohen was named Entrepreneur of the Year in 2002 by the Orange County Business Journal and was a finalist for Ernst & Young’s Entrepreneur of the Year in the medical company category in 2004. Mr. Cohen holds a B.S. in Business Management from the State University of New York at Binghamton. We believe Mr. Cohen’s extensive experience in the medical device industry qualifies him to serve on the Board.

Robert E. McNamara has served as a member of the Board and as Chair of our audit committee since November 2018.2018, and as a member of our nominating and corporate governance committee since April 2019. Since February 2018, Mr. McNamara has served as a member of the board of directors and audit committee of Xtant Medical Holdings, Inc. (OTCMKTS: XTNTW), a publicly traded manufacturer and marketer of regenerative medical products and devices.devices, and since February 2019, Chair of the compensation committee. Since June 2021, Mr. McNamara has served as a member of the board of directors, chair of the audit committee and member of the compensation committee for Teknova (TKNO), a publicly traded manufacturer and supplier of reagents and buffers to the pharma industry. Since April 2023, Mr. McNamara has been a member of the board of directors and chair of the audit committee of AVITA Medical (RCEL), a publicly traded regenerative medicine company developing and commercializing devices and autologous cellular therapies for skin restoration. Mr. McNamara previously worked at LDR Holdings/Spine, Inc., serving as its Executive Vice President from January 2013 to July 2016, and serving as its Chief Financial Officer from April 2012 to July 2016. From 2006 to 2009, Mr. McNamara served as a member of the board of directors and audit committee of Northstar Neurosciences, a publicly traded medical device company. From December 2004 to September 2008, Mr. McNamara was the Senior Vice President and Chief Financial Officer of Accuray, Inc., a publicly traded medical device manufacturer. In addition, Mr. McNamara has served as the Senior Vice President and

Chief Financial Officer of Somnus Medical Technologies and the Chief Financial Officer for Target Therapeutics, Inc., each publicly traded companies. Mr. McNamara is the former Mayor of Menlo Park, California. Mr. McNamara holds a B.S. in Accounting from the University of San Francisco and an M.B.A. in Finance from The Wharton School at the University of Business.Pennsylvania. We believe that Mr. McNamara’s extensive experience as an executive and director in the medical device industry and his prior service as a senior-level executive of medical device companies qualifies him to serve on the Board.